Note to the reader: This is the tenth in a series of articles I’m publishing here taken from my book, “Investing with the Trend.” Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of facts. The world of finance is full of such tendencies, and here, you’ll see some examples. Please keep in mind that not all of these examples are totally misleading — they are sometimes valid — but have too many holes in them to be worthwhile as investment concepts. And not all are directly related to investing and finance. Enjoy! – Greg

Secular Markets

For years (decades), analysts referred to long-term market cycles as generational markets. Ed Easterling has now defined them for us using a derivative methodology. Previously, most just looked at the price action and when it rose, called it a bull market, and when it declined or was flat, called it a bear market. I’m going to stick with Easterling’s process, as it comes with a lot of sound analysis and that removes the subjectivity.

Secular market cycles are long-term and have averaged about 25 years over the past 112 years. Secular bear markets average about 11.25 years in length over this period. Keep in mind, however, there are many cyclical bull and bear markets within the longer-term secular bear markets. Because I follow the analysis of Ed Easterling of Crestmont Research, here is my review of his book Probable Outcomes, published in 2011. This book, like his previous book Unexpected Returns, is a must-read to understand how long-term markets work.

Ed Easterling has done it again; provided a big picture approach to the market using time-tested historical data and sound principles. Ed’s first book, Unexpected Returns, was the first time I had heard of the way secular markets were defined — by valuations. Probable Outcomes expands and updates the first book. Easterling builds a methodology that is robust and clearly void of preconceived notions about the future; a refreshing approach rarely seen in books about the stock market.

The first part of the book is a lesson in market finance and economics from a practitioner view and not the usual financial academic approach — again quite informative and refreshing. Every concept is supported by data and colorful charts, which make learning and understanding the process enjoyable. He spends a great deal of time and effort to ensure that his explanations are easily understood and succinct. Secular markets are driven by long-term trends in Price Earnings ratios (PE), which, in turn, are driven by inflation/deflation. This removes the scale of time from the secular cycle definition and only uses the trends and cycles of PE and inflation as the identification of secular bear, and bear market cycle beginnings and endings. Simply, a secular bear begins when valuations peak and reverse because of a trend back toward low inflation, then continue to decline throughout the secular period. Once sufficiently low, usually single digit PE, a new secular bull period can begin.

The book wraps up with a thorough evaluation of how the current decade (2010–2019) could possibly play out (currently in a secular bear), using a large number of different EPS, PE, and Inflation combination scenarios. The message is clear, there are times (secular bears) that one needs to change their perspective on investing and seek an approach that at a minimum preserves capital so that when the next secular bull market begins, time is not spent trying to recover from the past secular bear. It is sad that most people spend a large part of their investing time trying to recover from previous losses. Understanding the secular approach and making the switch in your investing style (rowing vs. sailing) can lead to a long retirement accompanied by dignity and comfort.

I did have one question for Ed that somewhat bothered me. He was gracious enough to provide an excellent response.

My Question: With the average secular cycle being about 25 years and the total database being 112 years, do you feel there is enough data to be totally confident with your secular market analysis?

Ed’s Answer: “Absolutely. But let’s step back for a moment to consider the two types of cycles. You have asked a great question, because its answer reveals a lot about secular stock market cycles.

“There are two types of cycles: technical cycles and fundamental cycles. Technical cycles generally reflect patterns or levels that have a high propensity to repeat. Technical cycles gain their credibility and validity from a high degree of repeating incidences. The four full secular stock market cycles would hardly be considered high repetition. But secular stock market cycles are not technical cycles.

“Secular stock market cycles are fundamentally-driven cycles. By fundamentally-driven, I mean that economic and inflation factors cause the cycles to occur. Secular stock market cycles are more than patterns, they are reactions to hard drivers. Secular bulls and secular bears are driven by the trend and level of the inflation rate. Secular cycles are the adjustments to financial value that are caused by changes in the inflation rate. Since increases and decreases in the inflation rate change the expected rate of return, stocks and bonds increase or decrease in overall value and thereby add or detract from total return.

“Look at the secular bear market of the 1960s and 1970s. Rising inflation caused the valuation of stocks to decline. The market’s price/earnings ratio declined from more than 20 to less than 10 over 16 years. Earnings grew and investors received dividends, but the decline in valuation caused returns to be well-below average. Then as the inflation rate turned and declined, the 1980s and 1990s secular bull experienced the benefit of rising valuations as well as earnings growth and dividends.

“Okay, one last comment about secular cycles. There is another factor other than inflation that impacts them. The second factor is cash flow. The secular bear of 1929 was caused by deflation. Deflation causes the nominal cash flows from earnings and dividends to decline in amount. So even though the discount rate remains low as inflation neared zero and fell into deflation, the expected future decline in reported cash flows due to deflation caused the present value of the market to decline. P/E fell from more than 20 to less than 10. This is potentially instructive about the future, because recent trends in economic growth suggest that it may be slowing from the historical rate averaging 3 percent annual real growth. If economic growth slows, then future earnings growth will slow, too. As a result, the slower growth of cash flows will drive a lower valuation for the market. Growth rate affects the level of P/E.

“So we have fundamental principles related to the concepts of cash flow and present value. Then we have four full-cycle examples that are consistent with the well-accepted academic and industry principles. Is four full cycles enough to be confident about the concept of secular stock market cycles? Absolutely!”

Thanks Ed.

Easterling points out that these secular periods are not random as they follow each other; he actually calls them cycles. The driver of these cycles is the inflation rate as it moves toward and away from price stability. Trends of rising inflation and deflation drive the market valuation lower and result in low returns. As prices stabilize from either deflation or high inflation, valuations are driven upward and the result is high returns. Keep in mind that this is a process whereby moves away from price stability simultaneously cause PE to decline and low or no returns result. Moves toward price stability simultaneously cause PE to rise and result in high returns.

Furthermore, the relationship among inflation, earnings, and prices is neatly tied together. The S&P 500 is an index of capitalization weighted prices of 500 large-cap, blue chip stocks. Inflation is the annual rate of change of the consumer price index, which is a measure of various prices for goods and services. Valuations (earnings) are measured relative to price with the price-to-earnings ratio (PE). Once again, technical analysis arises because all three measures used to define secular markets are ultimately based on price.

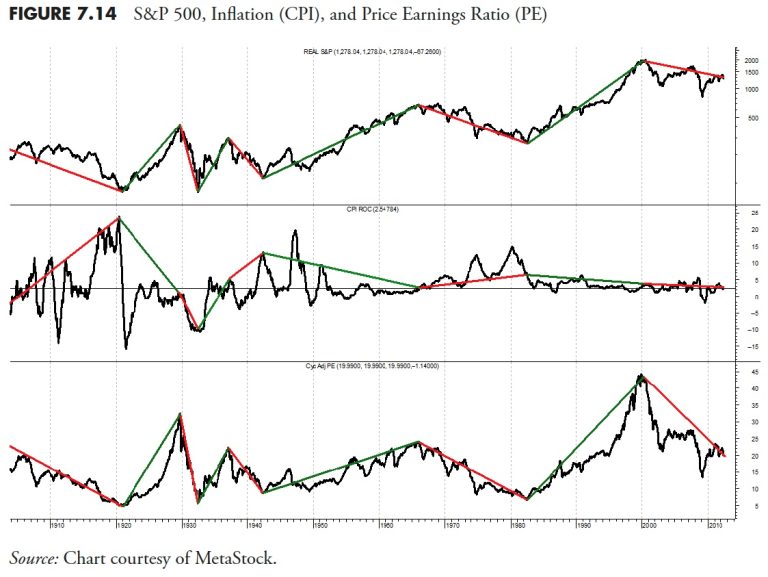

Figure 7.14 shows the monthly S&P 500 back to 1900, along with the 12-month rate of change of the Consumer Price Index (Inflation) and the S&P 500 PE Ratio at the bottom; both the prices and the PE ratio are adjusted for inflation (known as real). This makes the PE swings more readily identifiable. You can clearly see from this chart the significant moves in PE (bottom plot) and compare to the moves in the S&P 500 (top plot). The upward moves in the PE Ratio are the secular bulls and the downward moves are the secular bears. The middle plot of inflation shows how it affects valuations over time. Although the specific changes in inflation are not aligned with the peaks and troughs of price or valuation, it is reasonable to assume it leads them. It does appear that, when inflation is within the +2.5% and -1% range (small horizontal lines), its effect is not as great or as timely, and is usually during the Secular Bull markets. I think, from this chart, the fact that secular markets are defined by long-term swings in valuations, which are ultimately affected by inflation, bears (sic) out.

Figure 7.15 shows the exact same data as the previous but over a shorter time period so you can see the changes better. This chart shows the data since World War II. The clarity of the secular bull markets and bear markets in the top plot is obvious. The changes in overall inflation in the middle plot, while not as well defined, still exist, and the bottom plot shows the rise and fall of the price earnings ratio in conjunction with the other two.

Secular Bull Markets

Do not confuse brains with a bull market.

Don’t mistake a bull market for investment skill.

Martin Pring (strategist for Pring Turner Business Cycle ETF [DBIZ]), describes them thusly:

“Primary trend changes in secular (and cyclical) bull markets are usually short and shallow and each peak is higher than its predecessor. Investors are routinely assisted from their bad investment decisions by the bull market. Investors’ confidence grows significantly during these times and eventually becomes excessive, with the period from 1998 to 1999, known as the dotcom bubble, being a classic example. There are geniuses everywhere, and they are paraded hourly on financial television. Investment decisions that are considered irresponsible and careless at the beginning of secular bulls are hailed as perfectly routine as the secular bull matures. The lessons learned in the previous bear market are long forgotten and often you hear “this time is different.” When the majority of the above become common, the end of the secular bull is probably near, despite prognostications that it will go much, much higher.”

These prognostications are given with extreme determination and confidence. In a secular bull, one can buy and hold, invest in index funds, dollar cost average, just about anything. Here is the problem: most will not realize they are in a secular bull market until it is almost over.

Secular Bull Markets since 1900

Figure 7.16 shows the four secular bull markets since 1900. It should be clear that a secular bull is a time when caution goes out the window. Unfortunately, most will not realize it until toward the end.

Secular Bull Data

In Table 7.7, notice that all of the Secular Bull markets started when PE was between 5 and 11, and ended when PE was between 19 and 42. There are charts in the next chapter that show the secular changes in valuation.

Secular Bull Market Composite

The secular bull composite is shown in Figure 7.17 . Secular bull markets, if and when you know you are in one, can easily justify some of the investment strategies that this book considers as bad strategies for most investors. Of course, most will not realize they are in a secular bull until it is well developed.

Secular Bear Markets

Martin Pring says, “the secular bears are essentially the opposite of the bulls as, in general, the peaks are lower and the troughs are lower, exhibiting a downward trend. However, keep in mind that they are not always down-trending, and there is sometimes a new high in the middle. The key characteristics are declining price earnings ratio (PE) and low or no returns. Just like the secular bull, every lesson learned is quickly forgotten. Just like a recession cleanses the economy, the secular bear resets everything and removes all the excesses. Most secular bulls end and secular bears begin without there being a condition of excess. The high valuation of the market is the rational result of low inflation.

“Certainly there are moments of excess, just as normal market volatility creates short periods of excess and the opposite of excess. My key point is that secular tops and bottoms are the result of fundamental conditions rather than irrational emotions. The bearish prognosticators are once again the daily media darlings. And once again, just like in the secular bull, the forecasts are for total gloom and doom. The determination and confidence of these forecasters is convincing, yet eventually wrong.

“Here is something that is important to remember: Secular bear markets account for over 50% of the total time. In fact, as of 2012, there were actually more years in secular bears than in secular bulls since 1900. The previous two points are true but keep in mind that the period being observed has a secular bear at both ends. Since bears are not necessarily longer than bulls, and vice versa, it’s reasonable to say that they are about the same in length on average, but the range of terms varies significantly. Secular bear markets cause investors to seek alternative investments or unconstrained investments that protect them from downside losses. However, just like the secular bull, most will be in denial and not participate in the secular bear properly until sustained losses, and then it will probably be about over.”

The next section shows graphics of the various secular bear markets. They were created with monthly data for the S&P 500 from Robert Shiller’s database. If yearly data had been used, the message would be essentially the same.

Secular Bear Markets since 1900

Figure 7.18 shows all four of the previous inflation-adjusted secular bear markets, along with the current one from their starting point on the left side of the graph. Two of the secular bears were shorter, and two were longer, than the one that began in 2000. One cannot make an investment decision with this information — only an awareness that we are currently in a secular bear market (as of 12/31/2012) and it could last much longer.

Secular Bear Data

Ed Easterling says that secular markets are determined by long-term swings in valuations that are driven by inflation. From Table 7.8, you can see that the Great Depression secular bear did not involve a rise in inflation, but it also only lasted three years. As of this writing (2013), the secular bear that began in 2000 is still in progress.

Notice that the Secular Bear markets started when their PE was between 18 and 42, and ended when their PE was between 5 and 12. The starting PE for the first four Secular Bears was between 18 and 28. The Secular Bear that began in 2000 started at 42, which is an outlier for a starting PE. The next chapter shows charts similar to the secular charts displaying the changes in valuations over the various secular cycles.

Secular Bear Market Composite

Figure 7.19 shows the current secular bear (bold) with the average of the previous secular bears. Again, this information is just for awareness and understanding, as you cannot make investment decisions with this type of observation.

The Last Secular Bear Market (1966–1982)

Figure 7.20 shows that the last secular bear from 1966 to 1982 went sideways, with a number of large cyclical bull markets and bear markets. The message is simple — buy-and-hold, or index investing, did not go anywhere for 16 years. That’s a long time to not make any money in the market, especially when you are in your “retirement wealth accumulation” years. However, if you had a simple trend-following process where you could capture some of the good up moves and avoid most of the big down moves, you would have come out in 1982 significantly better off than buy-and-hold or index investing.

Notice the percentage moves and the amount of time that each took. When one shows 16 years of data, sometimes the compressed data can make it look like the frequency of up and down moves is much higher than it actually is. The up moves (cyclical bulls) averaged 23 months in length, with an average gain of over 52 percent. The down moves (cyclical bears) averaged almost 19 months with an average decline of -33 percent. Clearly, this falls in line with common knowledge that bull markets last longer than bear markets, even if they are contained in an overall secular bear market.

The next chapter is essentially a continuation of this chapter, delving into market valuations, market sectors, asset classes, various methods to observe returns, and the distribution of those returns.

Thanks for reading this far. I intend to publish one article in this series every week. Can’t wait? The book is for sale here.