“January provides us with a wealth of information that gets our year off to a good start, financially and emotionally.

“The data is specifically chosen to begin in 2009 because that is the bottom of the most significant bear market prior to the 2022 bear market, and 2009 represents the beginning of an era of distinctly different execution of monetary policy by the Federal Reserve.

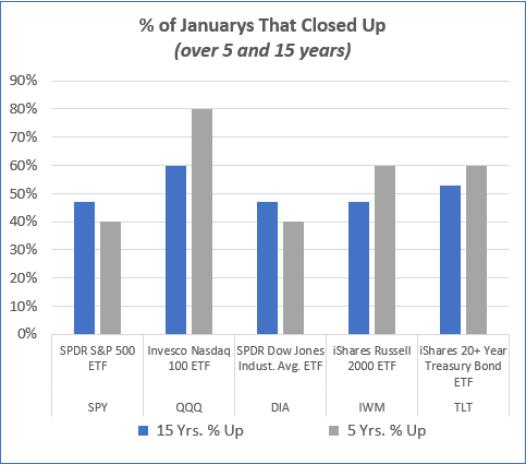

“There’s clearly one index that stands out. As you can see in the chart, QQQ is the best performer based on the percentage of times its January is positive. However, a 60% win rate over the last 15 years isn’t very impressive, and the other 3 stock indexes have actually been down more often than up over the 15-year period. So, one clear conclusion is that if you want to be long an index, QQQ has the best odds in January.”

That was Geoff Bysshe, President of MarketGauge.com.

However, right now, we are all about the Russells. Granddad Russell 2000 has been a stronger performer in January in the last 5 years.

We have started January 2024 thus far, weaker, but the real test will be 2-fold: first, whether IWM holds 180, and second, how IWM performs versus the 6-month high and low set in January.

This is the daily chart of IWM. The horizontal green line will be the one that is reset this month for the new 6-month January calendar range. IWM had a golden cross (the 50-DMA crosses above the 200-DMA), which puts this index officially in a bullish phase. With a reversal top, we can see a 5-10% decline as normal. That puts the target anywhere between 195 and 185.

Thus far on the second day in, IWM is trading around 195. Important to note is that the Leadership indicator shows IWM trading on par with SPY. Given that SPY is typically not as strong as IWM in January, we do not want to see IWM underperform the SPY.

Lastly, our Real Motion Indicator shows a mean reversion and a golden cross between its 50 and 200-DMAs.

We are encouraged that IWM is testing and holding support. We are encouraged that statistically, IWM has improved in January in the last 5 years. We are patient though, to see if Granny Retail XRT holds 70.00. And we are also patient on majorly adding discretionary swing trading positions until we see the January 6-month calendar ranges set.

Click this link to get your free copy of the Outlook 2024 and stay in the loop!

This is for educational purposes only. Trading comes with risk.

If you find it difficult to execute the MarketGauge strategies or would like to explore how we can do it for you, please email Ben Scheibe at Benny@MGAMLLC.com, our Head of Institutional Sales. Cell: 612-518-2482.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

Traders World Fintech Awards

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth.

Grow your wealth today and plant your money tree!

“I grew my money tree and so can you!” – Mish Schneider

Follow Mish on X @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

On the Tuesday, January 2 edition of StockCharts TV’s The Final Bar, Mish (starting at 22:21) talks small caps, retail, junk, and why all three matter in 2024 a lot.

In this appearance on BNN Bloomberg, Mish talks a particularly interesting chart, plus other places to invest in 2024.

In this appearance on Fox Business’ Making Money with Charles Payne, Mish talks with Cheryl Casone about Bitcoin’s volatility and why EVs may not be such a great place to invest in right now.

Recorded on December 28, Mish talks about themes for 2024 to look for, and tells you where to focus, what to buy, and what to avoid depending on economic and market conditions on Singapore Breakfast Bites.

Mish sits down with 2 other market experts to help you prepare for 2024 with predictions, picks, and technical analysis in StockCharts TV’s Charting Forward special.

Recorded December 27, Mish gives you a quick snippet of the overall macro prediction for 2024 on The Street with J.D. Durkin.

Coming Up:

January 5: Daily Briefing, Real Vision

January 22: Your Daily Five, StockCharts TV

January 24: Yahoo! Finance

Weekly: Business First AM, CMC Markets

ETF Summary

S&P 500 (SPY): 480 all-time highs, 460 underlying support.Russell 2000 (IWM): 195 near-term support, 180 major support.Dow (DIA): Needs to hold 370.Nasdaq (QQQ): 390 major support with 408 resistance.Regional Banks (KRE): 47 support, 55 resistance.Semiconductors (SMH): 160 major support and 170 now resistance to clear.Transportation (IYT): Needs to hold 250.Biotechnology (IBB): 130 pivotal support.Retail (XRT): Tested 70.00 level, which bulls need to see hold.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education